What is APR? Annual percentage rate (APR), is the cost you pay for borrowing money each year. Knowing your APR, can help you compare different loans and choose the one that is best for you.

An understanding of how APR works is crucial if you are considering taking out a loan, whether it is a credit card, auto loan, or mortgage.

But how does APR really work? And how can you use it to your advantage? Here’s what you need to know.

How does APR Work?

If you carry a balance on your credit card from one month to the next, you’ll be charged interest on that balance. Interest is usually expressed as an Annual Percentage Rate (APR).

Most credit card companies offer a grace period on new purchases. That means if you pay off your entire balance in monthly payments by the due date, you won’t be charged any interest. However, if you only make a partial payment, or if you make no payment at all, you’ll be charged interest on the outstanding balance from the previous

How Is Your APR Calculated?

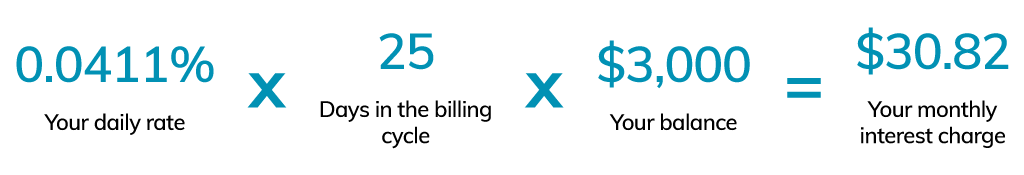

The amount of interest you owe on your outstanding loan balance varies by lender, but the formula is generally similar. For example, let’s say your card’s APR is 15 percent and your average daily balance during a 25-day billing cycle is $3,000.

To calculate APR, use the following steps:

First, divide the APR rate by 365 days to get the daily rate.

Next, multiply the daily rate by the number of days in the billing cycle and the balance. This is your cost of borrowing monthly interest rate.

You should also consider if the APR includes any fees, rewards, and other features. Remember, the APR is just one factor to consider when choosing how to borrow money. By doing your research, you can find the best credit card for your needs.

Types of Annual Percentage Rates

Understanding the different types of Annual Percentage Rates can help you make informed decisions when borrowing money. Remember, not all APRs are created equal.

Credit card APRs, for example, are typically much higher than the APRs on a car loan. This is because credit cards are considered to be a higher risk by lenders. As a result, they charge a higher rate of APR to offset this risk.

Similarly, the APR on a home loan is usually lower than the APR on a car loan. This is because homes are usually seen as a more stable investment by lenders and thus carry less risk.

Types of APRs Explained

Understanding these different types of APRs can help you make informed choices when taking out loans and can save you money in the long run.

Here are a few types of APRs to be aware of:

Purchase APR

The rate that’s applied to purchases made with a credit card.

Cash Advance APR

The rate at which you can borrow money with your credit card. If you use your credit card for cash advances, the APR will be higher than what’s offered on purchases. There may be a different Annual Percentage Rates for checks or certain types of cash advances, and there’s no grace period.

Penalty APR

Violations of your card’s terms, such as missing a payment or being late with a payment, can cause your APR to increase.

Introductory or Promotional APR

New credit cards may come with a low rate offer for a limited period of time. This may apply to purchases or specific transactions like balance transfers.

What is the difference between a fixed APR and a variable APR?

APR of a loan can be either fixed or variable. So what’s the difference between fixed APR and variable APR?

Fixed APR means that the interest rate will remain the same for the life of the loan. A variable APR, fluctuates based on index changes.

Fixed APR

A fixed APR is just what it sounds like: Your interest rate will not change, no matter what happens with the market or other economic factors.

This does not mean that the interest rate will never change. Your lender generally must notify you before the change occurs, and in most circumstances can apply the higher rate only to purchases and other transactions you make after you get the notice.

Variable APR

A variable APR, on the other hand, will fluctuate along with changes to the index rate. This means your payments could go up or down depending on market conditions. However, variable rates usually start out lower than fixed rates. So if you think rates will decrease in the near future, a variable APR could save you money in the long run.

Your loan agreement will inform you how your rate can change over time.

What Impacts Your APR?

It’s important to know the factors that influence your APR. Some factors you have control over and others you do not.

Here are some factors that go into determining your APR:

Credit history

If your credit history indicates that you are at a higher risk of defaulting, lenders may charge a higher APR.

Income

To determine whether you can afford to take on more debt, lenders look at your debt-to-income ratio (DTI). This is the percentage of your gross monthly income that goes toward your monthly debt payments. If you have a high DTI, you may experience a higher APR or be denied the loan.

Fees and other charges

Fees and other charges can be included in the APR, which could cause your interest rate to go up.

Prime rate

The prime rate is a benchmark that lenders use when setting their interest rates. It is directly impacted by the Federal Reserve federal funds rate. The prime rate may influence the interest rate you’ll get on new loans, but it won’t affect your open accounts unless the APR is variable.

Loan type

Some loans charge higher interest rates than others. Mortgage loans and auto loans, for instance, typically have lower APRs because you’re using the home or car you’re purchasing as collateral to secure the loan. This reduces the risk to the lender.

On the other hand, Personal loans, credit cards, and other unsecured loans typically have a higher in.

Improve Your Credit To Qualify For Lower APRs

A lender looks at more than just your credit score when calculating your APR. They’ll also take into account your credit history, which can help you qualify for a lower rate.

You can check your credit score and get a copy of your credit report to see where you stand and if there are any errors. Improving your credit does not guarantee the most favorable APR, but it will give you the chance to qualify for a lower rate. This can save you money over time.

Read More: Does applying for personal loan hurt credit?

Bottom Line

When it comes time for you to borrow money and choose a loan, it’s important to understand all of the different factors that go into the APR.

The best way to make sure you get a good deal is to compare APRs from different lenders. Remember that your credit score will also play a role in determining what kind of APR you qualify for, so be sure to keep track of your credit score and work on improving it if necessary. By understanding how APRs work, you can take control of your finances and choose the right loan for your needs.

Looking for a Personal Loan?

Explore your options today!

FAQ's

APR stands for annual percentage rate, and is the yearly cost of borrowing money, including interest and fees.

You calculate APR by taking the yearly interest rate, dividing it by 365 to get a daily rate, then multiplying by your balance and the number of days you’re borrowing.

Fixed APR doesn’t change over time, while variable APR can go up or down based on the economy.

Credit cards are riskier for lenders than loans like car loans, so they charge more.

Improve your credit score, lower your debt, and compare offers from different lenders.