In times of emergency, emergency loans can provide fast cash when you need it most. They are a good way to cope with unforeseen expenses.

When an emergency strikes, knowing what steps to take can be difficult. Unexpected expenses like a medical bill or auto repair can leave you feeling stressed and wondering where the money will come from.

Let’s take a closer look at emergency loans, what they are and how you can get one.

What is an emergency loan?

An emergency loan is a type of personal loan that can be taken out quickly to help someone during an unexpected, urgent situation. When you need fast funding to take care of an unexpected expense, emergency loans can be used for any number of things, from repairing a car and settling large medical bills.

Looking for a Personal Loan?

Explore your options today!

How do emergency loans work?

Emergency loans are typically unsecured personal loans that provide quick access to funds. Within one to two business days after your loan has been approved, the funds will be deposited in your account.

Unsecured emergency loans do not require collateral. Therefore, you won’t have to worry about losing your house or car if you can’t repay the loan. Failure to repay your loan can damage your credit score.

Lenders will examine your credit history and income to determine whether you qualify for a loan. Shopping around and comparing your options is a good idea if you want a loan with the most attractive terms.

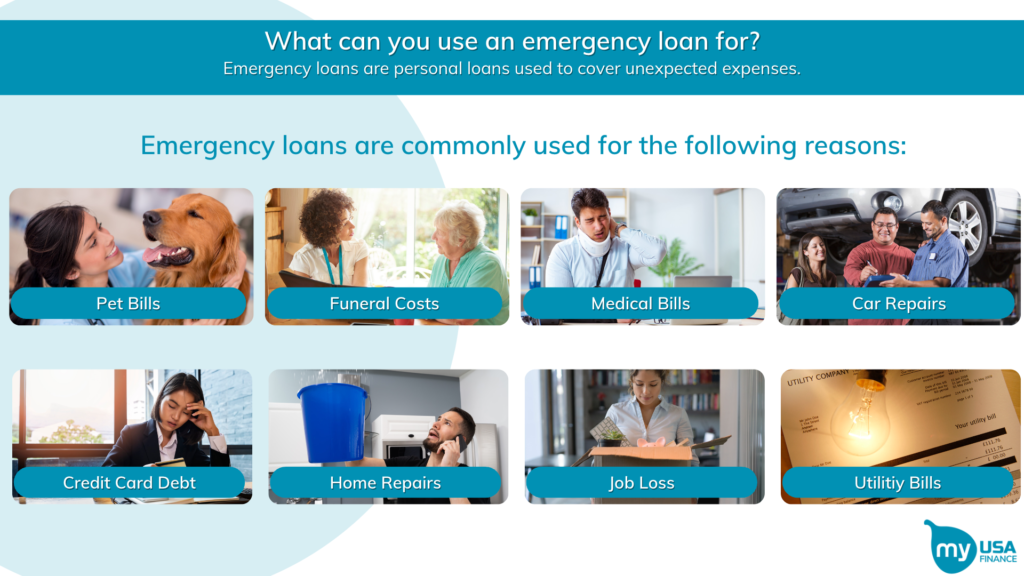

What can you use an emergency loan for?

Emergency loans are unsecured personal loans that can be used for anything, including bills and emergency expenses. Some common uses for an emergency loan include:

- Medical bills: Unexpected medical expenses or bills from the emergency room

- Rent or mortgage payments: You owe rent or mortgage payments, but you don’t have the funds

- Bills: Overdue utility bills such as electricity or internet

- Funeral expenses: If the funeral costs of a family member are not covered by insurance

- Home repairs: that need to be fixed right away. For example, a roof replacement, a HAVC system installation, or a refrigerator repair. The cost of home repairs varies greatly but HomeAdvisor estimates that they range from $3,954 to $20,260.

- Car repairs: Immediate repairs, such as replacing radiators or getting new tires. According to AAA, regular repair costs are usually between $500 and $600 or more.

- Job loss: When you no longer have a job and have difficulty paying for your living expenses

- Pet Bills: Expensive vet bills, such as emergency surgery or medical care for your pet

- High-interest credit card debt: Make one monthly loan payment for all your credit card debt

Looking for a Personal Loan?

Explore your options today!

Where can I find emergency loans?

Finding the right lender for your needs is crucial when you need a fast emergency loan. There are different types of lenders you can choose from.

The following types of lenders most commonly provide emergency personal loans:

Online Lenders: often offer loans even to borrowers with bad credit and are fast in processing loan applications and disbursing funds.

Banks: are more likely to offer higher limits and longer repayment terms, but the processing time can sometimes be lengthy.

Credit Unions: you will usually have to meet certain membership requirements before taking out a loan.

How to get an emergency loan

Getting an emergency loan can be a helpful option when you need quick cash to cover an urgent expense. When you are ready, follow these four steps to apply for an emergency loan:

- Shop around. For the best rate and terms, compare loan offers from different lenders.

- Apply for loan. The next step is completing an application with the chosen lender. Provide all required documents, such as bank statements, income proof, address, and identification.

- Review your loan offer. If your loan is approved, carefully review the loan offer and select the payment date that fits your schedule. Accept your loan by signing the documents.

- Make payments on your new loan. Consider setting up automatic payments if you want your monthly loan payments to be on time.

Looking for a Emergency Loan?

Explore your options today!

Bottom Line

An emergency loan is a great way to get quick cash when you need it most. Some common uses for an emergency loan include medical bills, rent or mortgage payments, and overdue utility bills.

To get the best interest rate and terms on an emergency loan, it is important to compare offers from different lenders.

My USA Finance is a great option for borrowers who need fast access to funds. You can compare rates from different lenders, and we’ll find the best loan for you. Even bad credit borrowers can get emergency loans from us.

My USA Finance can help you take control of your finances today.

Frequently Asked Questions

No, emergency loans are typically unsecured personal loans with more reasonable interest rates and repayment terms compared to payday loans, which often have high interest rates and short repayment periods.

Yes, some online lenders specialize in loans for people with bad credit.

Yes, some people use emergency loans to consolidate high-interest debt into a single, more manageable payment.